Ritual: Disrupting the Supplement Industry Through Radical Transparency

If you're considering entering the supplement space or looking to differentiate your existing brand in a crowded market, Ritual's journey offers valuable insights.

In an industry often criticized for its opacity, one brand has built a $100+ million business by showing consumers exactly what they're putting in their bodies. Ritual, the subscription-based supplement company, has transformed how discerning health-conscious consumers think about vitamins and supplements through an uncompromising commitment to transparency and quality.

If you're considering entering the supplement space or looking to differentiate your existing brand in a crowded market, Ritual's journey offers valuable insights. Let's explore how this relatively young company has managed to disrupt a mature industry and what lessons you can apply to your own supplement business.

The Origin Story: Solving a Personal Problem

Like many successful businesses, Ritual began with a founder experiencing a problem firsthand. In 2015, Katerina Schneider, a venture capital investor, became pregnant and began scrutinizing the ingredients in her prenatal vitamins. What she discovered was disturbing: many contained artificial colorants, unnecessary fillers, and potentially harmful ingredients she was actively avoiding in other products.

"I couldn't find a single vitamin brand I trusted," Schneider has explained in interviews. Rather than settling, she decided to create the vitamin she wished existed.

Schneider left her position at angel fund Collaborative and raised $1.3 million in seed funding to launch Ritual in 2016. Her vision: create a supplement brand built on radical transparency, using only essential ingredients in their most effective forms.

Key Takeaway: The most compelling businesses often stem from authentic founder problems. If you're entering the supplement industry, consider what genuine unmet need you can address rather than simply creating another "me-too" product.

Product Lineup: Targeted Simplicity

Rather than overwhelming consumers with dozens of options, Ritual began with a single product: Essential for Women 18+, a multivitamin containing just nine nutrients designed to fill common gaps in women's diets. This focused approach allowed the company to perfect its flagship product before expanding.

Today, Ritual's product lineup includes:

Multivitamins:

Essential for Women 18+ (9 nutrients for women 18-49)

Essential for Women 50+ (8 nutrients optimized for post-menopausal needs)

Essential Prenatal (for pregnancy, includes extra iron, choline, and folate)

Essential Postnatal (for postpartum and breastfeeding mothers)

Essential for Men 18+ (8 nutrients tailored for men 18-49)

Essential for Men 50+ (adjusted for older men's metabolic and muscle needs)

Essential for Teens (versions for both boys and girls 13-17)

Proteins:

Essential Protein Daily Shake 18+ (20g organic pea protein per serving)

Essential Protein Daily Shake 50+ (with added calcium and choline)

Essential Protein Pregnancy & Postpartum (enhanced with choline)

Specialized Supplements:

Synbiotic+ (3-in-1 gut health formula with prebiotics, probiotics, and postbiotics)

HyaCera (skin health supplement with hyaluronic acid and ceramides)

Sleep BioSeries (innovative extended-release melatonin formula)

Stress Relief BioSeries (adaptogens and botanicals for stress management)

What's notable about Ritual's approach is its restraint. Rather than including every possible nutrient, each formula contains only what the company believes is essential based on nutritional research. For instance, the women's multivitamin excludes calcium and vitamin C on the premise that most women get enough from their diets.

Each product is formulated for a specific demographic and life stage, allowing for precise nutrient targeting rather than a one-size-fits-all approach. This demonstrates a sophistication that resonates with educated consumers who appreciate nuance over megadoses.

Key Takeaway: Instead of trying to be everything to everyone, consider focusing on specific customer segments with targeted formulations. Quality and precision can be more compelling than comprehensiveness.

Ingredient Transparency: Setting a New Standard

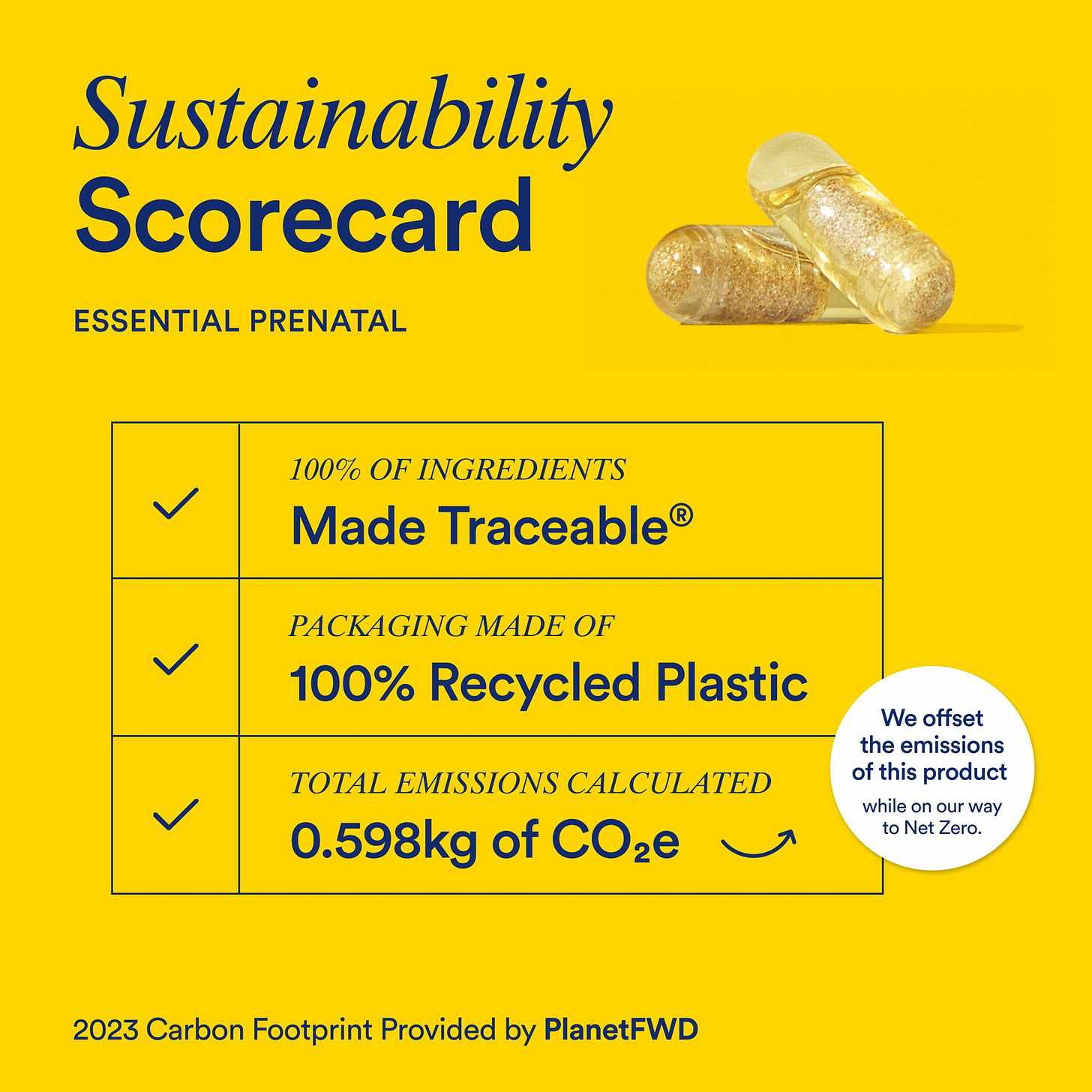

Ritual's most disruptive innovation isn't in its formulations but in its unprecedented commitment to transparency. The company has created a "Made Traceable" program that discloses:

Ingredient sources: Every nutrient's origin is identified, down to the specific supplier and country of origin.

Form rationale: Ritual explains why specific nutrient forms were chosen (like methylated folate instead of folic acid for better bioavailability).

Exclusion justification: The company openly discusses why certain nutrients weren't included, rather than simply touting what's inside.

Manufacturing details: Information about production facilities and processes is readily available.

Testing protocols: Ritual outlines its quality control measures, including third-party testing for purity and potency.

This transparency extends to the physical product itself. Ritual's signature clear capsules with visible beadlets symbolize the "nothing to hide" approach that has become the brand's hallmark. The delayed-release capsule technology allows nutrients to be delivered to the small intestine rather than the stomach, potentially reducing nausea and improving absorption.

The company has secured impressive third-party verifications to validate its quality claims. Most notably, Ritual's Essential for Women 18+ multivitamin earned USP Verification – an independent certification from the U.S. Pharmacopeia that verifies the product's content, purity, and potency meets label claims. This distinction is rare in the supplement industry and provides powerful credibility.

Additional certifications include:

Informed Sport certification for protein products (verifying absence of banned substances)

Certified B Corporation status (achieved in 2022)

Non-GMO Project verification for applicable products

Key Takeaway: In an industry plagued by consumer skepticism, exceptional transparency can be your greatest differentiator. Consider how you can go beyond regulatory requirements to build trust through radical openness about your ingredients and processes.

Business Model: Subscription Foundation with Retail Expansion

Ritual launched as a direct-to-consumer (DTC) subscription business, a model that offers several advantages:

Predictable revenue: Monthly recurring payments create stable cash flow.

Higher lifetime value: Subscribers tend to remain customers longer than one-time purchasers.

Direct customer relationships: No retail middlemen means direct communication with users.

Data collection: Subscription behavior provides valuable insights for product development.

The subscription model aligns perfectly with vitamin consumption, which ideally happens daily over months or years. Ritual positions its subscription as helping customers maintain consistent healthy habits – turning supplementation into a "ritual," as the name suggests.

Price points reflect the premium positioning:

Multivitamins: $30-40 monthly

Specialty supplements: ~$54 monthly

Protein powders: ~$40 for 15 servings

While the subscription foundation remains central to Ritual's business, the company has strategically expanded into retail channels in recent years:

Whole Foods: In 2022, Ritual made its first foray into brick-and-mortar retail with an exclusive partnership with Whole Foods Market.

Target: In 2023, Ritual expanded to Target stores, particularly in their "clean" product sections.

Amazon: The company maintains an official storefront on Amazon, where customers can make one-time purchases.

This omnichannel approach allows Ritual to reach consumers who prefer shopping in stores while maintaining its subscription base online. Notably, the company's website remains subscription-only – you cannot make a one-time purchase on Ritual.com.

Key Takeaway: Consider a hybrid business model that captures the benefits of subscription while allowing discovery through retail channels. The predictability of subscription revenue can provide the foundation for expanding into other distribution methods.

Financials: Venture-Backed Growth

Ritual has attracted significant venture capital investment to fuel its growth:

Seed round (2016): $1.3 million initial funding

Series A (2017): $10.5 million led by Forerunner Ventures

Series B (2019): $25 million led by Norwest Venture Partners

Total funding: Approximately $40.5 million

This capital has enabled aggressive customer acquisition and product development. By 2021, just five years after launch, Ritual had achieved impressive milestones:

Annual revenue: Exceeded $100 million

Customer base: Over 1 million unique customers served

Team size: 130+ employees based in Culver City, CA

While specific profitability figures aren't public, Ritual's business model suggests healthy unit economics. The company reportedly enjoys approximately 70% gross margins on its vitamins, allowing significant investment in marketing, R&D, and customer experience while moving toward profitability.

Valuation estimates from secondary market data in 2022 suggested a valuation around $268 million post-Series B. This represents a substantial multiple on investment for early backers, though still places Ritual in the mid-sized rather than unicorn category of startups.

Key Takeaway: The supplement industry can support venture-scale businesses with the right combination of product differentiation, strong unit economics, and effective customer acquisition strategies. Consider whether your supplement concept has the potential for similar rapid scaling.

Market Positioning: Premium and Science-Driven

Ritual has carefully crafted a distinctive market position that separates it from both legacy vitamin brands and newer competitors:

Target demographic: While now serving broader segments, Ritual initially focused on millennial women – particularly those starting to think about fertility and pregnancy. This demographic tends to be highly research-oriented in their purchasing decisions and willing to pay for quality when it comes to health.

Brand aesthetic: Ritual's visual identity is dominated by a bright "Ritual yellow" color scheme and minimalist design that stands out sharply against traditional supplement packaging. The transparent bottles showcasing the clear capsules create an instantly recognizable product.

Value proposition: Rather than competing on price or comprehensiveness, Ritual emphasizes:

Essential nutrients only (no unnecessary extras)

Premium ingredient forms selected for bioavailability

Unmatched transparency in sourcing and manufacturing

Delayed-release technology for better absorption

Vegan, gluten-free, non-GMO formulations without artificial additives

Communication style: Ritual's tone is educational rather than sensationalist. The company avoids miraculous claims in favor of straightforward explanations of nutritional science. This approach builds credibility with skeptical consumers who have grown weary of supplement industry hyperbole.

What's particularly effective about Ritual's positioning is how perfectly it aligns with broader consumer trends toward clean labels, supply chain transparency, and evidence-based wellness. The brand sits at the intersection of these movements, making it feel both innovative and intuitively right to its target customers.

Key Takeaway: Instead of competing on price or comprehensiveness, consider how your supplement brand can align with broader consumer value shifts. The most compelling positioning often reflects cultural movements rather than merely product attributes.

Customer Reviews: Mixed but Leaning Positive

Customer feedback on Ritual reveals both strong loyalty among core users and some friction points worth noting:

Positive themes:

Clean ingredients: Users frequently praise the absence of fillers and artificial additives.

Stomach-friendliness: Many note they can take Ritual vitamins on an empty stomach without nausea.

Pleasant taste/smell: The mint tab included in the capsules to mask fish oil odor receives frequent positive mentions.

Convenience: Subscribers appreciate the reliable monthly delivery that helps maintain consistency.

Perceived efficacy: Some users report improvements in energy, hair strength, and nail growth after consistent use.

Negative themes:

Subscription issues: The most common complaints relate to unexpected recurring charges and perceived difficulty canceling.

Digestive reactions: A subset of users report "vitamin burps" or queasy feelings, particularly with prenatal formulas.

Price concerns: Some question the value relative to more comprehensive drugstore alternatives.

Limited formulation: Certain users wish for more nutrients included in the multivitamins.

The polarization in reviews is reflected in Ritual's ratings on third-party platforms. While the company showcases glowing testimonials on its website, its Trustpilot rating hovers around 2 out of 5 stars, largely due to subscription management complaints. Amazon ratings are mixed but generally more favorable at around 3 stars.

This pattern suggests that Ritual has created a product that inspires genuine enthusiasm among those who connect with its philosophy but may face challenges with those who encounter subscription friction or have different expectations about what a multivitamin should include.

Key Takeaway: When designing your supplement business, pay careful attention to the entire customer experience – not just the product itself. Subscription management, customer service, and communication can significantly impact satisfaction and word-of-mouth.

Scientific Backing: Evidence-Based Formulation

Ritual distinguishes itself by grounding its products in scientific research and ongoing testing:

Formulation approach: The company states its products are "backed by 12,000+ scientific studies," referencing the body of research consulted during development. While this doesn't mean Ritual conducted these studies, it indicates an extensive literature review informs their formulations.

Clinical validation: Most notably, Ritual funded a 12-week double-blind, placebo-controlled clinical trial of its Essential for Women 18+ multivitamin in partnership with Auburn University. Published in the peer-reviewed journal Frontiers in Nutrition in 2021, the study demonstrated that women taking the supplement experienced significant increases in vitamin D, omega-3 DHA, and folate levels compared to placebo.

Branded ingredients: Ritual uses clinically-studied branded ingredients in many of its products. For example:

The hyaluronic acid (Hyabest®) and ceramides (Ceratiq®) in HyaCera match doses shown effective in clinical trials

The probiotic strains in Synbiotic+ (LGG® and BB-12®) are among the most researched probiotics available

Scientific leadership: The company's team includes a Chief Scientific Officer and VP of Scientific & Clinical Affairs who guide formulation decisions and research initiatives.

This evidence-based approach stands in contrast to many supplement companies that rely primarily on marketing claims rather than scientific validation. By investing in clinical trials and using research-backed ingredients, Ritual builds credibility with healthcare professionals and educated consumers alike.

Key Takeaway: Consider how you can incorporate genuine scientific validation into your supplement brand. While clinical studies require investment, they can provide powerful differentiation in a market flooded with unsubstantiated claims.

Competitive Analysis: How Ritual Stacks Up

To fully understand Ritual's market position, it's helpful to compare it with key competitors:

Care/of: Like Ritual, Care/of is a subscription-based vitamin company with modern branding. However, Care/of takes a more personalized approach, offering a quiz and customized daily packs with various supplements. Their basic multivitamin is cheaper (about $15/month vs. Ritual's $30+) but lacks omega-3s and some premium ingredient forms. Care/of offers more variety through its mix-and-match system, while Ritual provides streamlined simplicity with its all-in-one approach.

SmartyPants: Known for gummy vitamins targeting families, SmartyPants offers more comprehensive nutrient arrays at lower price points (around $18/month). Their products include sugar and other ingredients to create the gummy format, which some health-conscious consumers may avoid. While SmartyPants emphasizes quality, it doesn't provide the same level of traceability or sourcing transparency as Ritual. The choice between these brands often comes down to format preference and price sensitivity.

GEM: Taking a completely different approach, GEM offers nutrition "bites" made from whole food ingredients instead of traditional supplements. These food-based alternatives contain additional ingredients like probiotics and botanicals but don't differentiate formulas by gender or life stage. At around $55/month, GEM is actually more expensive than Ritual but appeals to consumers who prefer whole foods over isolated nutrients. GEM offers novelty in format but provides less transparency about sourcing than Ritual.

Legacy brands (Nature Made, One A Day, Centrum): Traditional drugstore multivitamins are significantly cheaper (often under $10/month) and contain more comprehensive nutrient arrays. However, they typically use less bioavailable forms of vitamins and minerals and provide minimal transparency about sourcing. Ritual's premium positioning distinguishes it from these mass-market options through quality ingredients, traceable supply chains, and modern branding.

Ritual has carved out a distinctive position in this competitive landscape by offering the perfect balance of simplicity, transparency, and premium quality. While not the cheapest option, it provides a compelling value proposition for consumers who prioritize clean ingredients and traceable sourcing.

Key Takeaway: Understand your competitive landscape thoroughly, but don't try to be all things to all people. Ritual succeeds by maintaining a clear identity rather than chasing competitors' features.

Sump Up

Ritual has demonstrated that even in a mature, crowded industry like supplements, there's room for disruptive innovation. By reimagining what transparency could mean in this category, Katerina Schneider and her team built a $100+ million business in just five years.

The company continues to face challenges, from increased competition adopting similar transparent messaging to the operational complexities of maintaining quality at scale. Yet its core approach – combining radical openness with premium quality and education-focused marketing – provides a compelling template for aspiring supplement entrepreneurs.

As you consider your own entry into this space, remember that the most successful supplement brands don't just sell products – they sell trust. In a category where consumers have grown skeptical of exaggerated claims and hidden ingredients, earning and maintaining that trust may be your most valuable competitive advantage.

Are you building a supplement brand or considering entering this market? What aspects of Ritual's approach resonates most with your vision? Share your thoughts in the comments below!