OPositiv: How a Personal Health Struggle Created a Women's Wellness Empire

In the crowded supplement industry, few brands have disrupted the market as effectively as OPositiv. Founded by siblings Brianna and Bobby Bitton, this women's health supplement company took a bold approach to addressing historically taboo topics like PMS, menopause, and vaginal health. Their eCommerce-first strategy, coupled with strategic retail expansion, has transformed OPositiv from a single-product startup into a leading force in women's wellness.

The Origin Story: From Personal Pain to Market Solution

OPositiv's journey began with Brianna Bitton's personal struggle with debilitating PMS symptoms and undiagnosed PCOS. After years of suffering and limited options for relief, a family brainstorming session with her brother Bobby and their inventor mother sparked an idea: create a preventative, proactive supplement for PMS symptoms.

"If women have been experiencing hormonal shifts for millions of years, why were there so few products designed to support them?" This question became the catalyst for OPositiv's mission.

Drawing on their family's entrepreneurial background (with over 20 patents collectively), the Bittons spent months in R&D, collaborating with nutritionists and doctors to perfect what would become their flagship product: FLO PMS Gummies, the first-ever gummy vitamin specifically formulated for PMS relief.

Business Model Innovation: The DTC Subscription Advantage

OPositiv launched in 2018 with a direct-to-consumer approach focused on building lasting customer relationships through subscriptions. Their website offers products as one-time purchases (around $32) or monthly subscriptions (approximately $27, a 15% discount) - encouraging consistent use for ongoing health concerns.

This subscription model proved ideal for their target market for several reasons:

PMS, menopause, and vaginal health issues are recurring, creating natural demand for ongoing product use

The subscription discount incentivizes loyalty while providing predictable revenue

Direct customer relationships allowed for valuable feedback to inform product development

The company enhanced this model with a user-friendly website featuring educational content ("The Daily Vitamin"), medical advisory board credibility, and a referral program that leverages satisfied customers as brand ambassadors.

Product Expansion Strategy: From First Period to Last

OPositiv's success with FLO provided the foundation for a systematic expansion across the women's health journey. Each new product addressed a specific underserved need:

FLO: PMS relief and hormonal balance (flagship product)

MENO: Menopause support (first gummy vitamin for menopause symptoms)

URO: Vaginal health probiotic (addressing UTIs and vaginal flora)

PREGGO: Prenatal support

This methodical approach allowed OPositiv to increase customer lifetime value by offering solutions "from first period to well beyond your last." Rather than competing broadly with general supplement brands, they carved out category-defining niches within women's health that lacked innovative solutions.

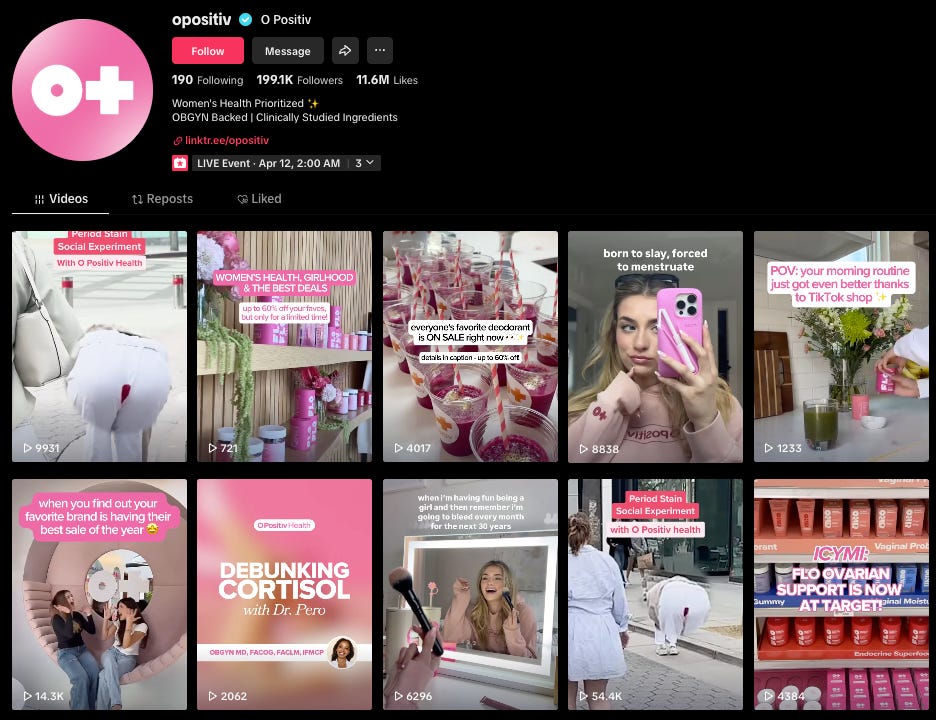

The TikTok Effect: Viral Marketing Success

Perhaps the most fascinating aspect of OPositiv's rise has been its masterful leveraging of social media, particularly TikTok. The brand experienced explosive growth when users began posting authentic testimonials about FLO's effectiveness for issues like hormonal acne, cramps, and mood swings.

These candid reviews - often humorous and relatable - garnered millions of views and created a cult following. One viral TikTok creator praising FLO for clearing hormonal acne reportedly contributed to a product sellout shortly afterward.

OPositiv capitalized on this organic momentum by:

Resharing user testimonials across platforms

Partnering with micro-influencers for authentic content

Creating community hashtags like #FLOFriday

Facilitating frank discussions about previously taboo topics

This strategy proved particularly effective because it addressed a genuine market gap. As Brianna Bitton noted, "O Positiv was able to scale because there were huge parts of a women's health journey, like PMS and menopause, which were going undiscussed."

Channel Expansion: From DTC to Omnichannel

While OPositiv began as a DTC brand, they've executed a textbook example of strategic channel expansion:

Phase 1: Direct-to-Consumer (2018)

Website launch with subscription focus

Community building through content and testimonials

Direct customer feedback informing product improvements

Phase 2: Amazon Marketplace (c.2020)

Expanded reach to marketplace shoppers

Maintained pricing consistency to avoid channel conflict

Leveraged Subscribe & Save to mirror DTC subscription model

Phase 3: Retail Expansion (c.2022-2023)

National partnerships with Target and CVS

In-store presence increasing brand visibility

Consistent pricing across channels maintaining brand value

This methodical expansion allowed OPositiv to reach different customer segments while maintaining brand integrity. The move into retail, in particular, signaled the brand's maturation and positioned them alongside established supplement companies.

Competitive Positioning: Premium but Accessible

In the women's supplement landscape, OPositiv has carved out a distinct position:

OPositiv's competitive advantage comes from several factors:

First-mover advantage: Category-creating products like the first PMS gummy and first menopause gummy

Authentic founder story: Brianna Bitton's personal experience creates credibility

Specialized formulations: Targeted solutions vs. general wellness supplements

Community-driven growth: Social proof through reviews and testimonials

Premium but not luxury pricing: Accessible enough for their target demographic

Challenges and Future Outlook

Despite OPositiv's impressive growth, several challenges lie ahead:

Increasing Competition: As the women's wellness category grows, more brands are entering the space with similar products targeting hormonal and vaginal health. OPositiv will need to continue innovating to maintain its edge.

Retail Execution: While expanding to Target and CVS increases distribution, it also introduces supply chain complexities and potentially dilutes the direct customer relationship that fueled early growth.

International Expansion: The global market presents significant growth opportunities, but will require navigating different regulatory environments for supplements and cultural attitudes toward women's health topics.

Clinical Validation: As the market matures, consumers may demand more scientific evidence. OPositiv has relied on well-known nutraceutical ingredients rather than conducting formal clinical trials - a strategy that may need evolution.

For future growth, OPositiv appears positioned to:

Expand into adjacent categories within women's health

Enter international markets where women's health is similarly underserved

Develop more specialized formulations for specific conditions

Potentially explore retail-exclusive products or formulations

Key Takeaways for eCommerce Brands

OPositiv's success offers valuable lessons for emerging brands:

1. Find genuine market gaps. Brianna Bitton's personal struggle identified a real need that existing products didn't solve - creating authentic motivation and product-market fit.

2. Leverage social proof at scale. By encouraging and amplifying user-generated content, especially on platforms like TikTok, OPositiv created momentum that traditional advertising couldn't buy.

3. Build a multi-channel strategy. Starting DTC provided control and customer insights, while later expansion to Amazon and retail brought scale and new customer acquisition.

4. Create a subscription-worthy product. OPositiv's products address ongoing health needs, making them natural fits for subscription models that provide predictable revenue.

5. Break taboos with empathetic marketing. By speaking candidly about women's health issues and creating friendly, accessible solutions, OPositiv opened conversations that traditional brands avoided.

The supplement industry has no shortage of new entrants, but few have executed as effectively as OPositiv in identifying an underserved niche, building a passionate community, and scaling through strategic channel expansion. As they continue to grow, they've set a blueprint for how modern wellness brands can evolve from direct-to-consumer startups into omnichannel category leaders.