ARMRA's Colostrum Revolution: How a Doctor-Founded Startup is Redefining Supplement eCommerce Success

"We've achieved incredible growth online, but how do we scale without diluting what makes ARMRA special?" reflected Dr. Sarah Rahal as she prepared for the upcoming board meeting in early 2024. As founder and CEO of ARMRA, a premium bovine colostrum supplement company she had launched just four years prior, Rahal faced critical strategic decisions that would determine the brand's trajectory in an increasingly competitive market.

Introduction

In January 2024, ARMRA was at a pivotal inflection point. The direct-to-consumer supplement brand, known for its bovine colostrum products promising immune support and gut health benefits, had experienced explosive growth since its 2020 founding. Annual revenue approached $150 million, a remarkable achievement for a young wellness startup offering a relatively niche supplement. The company's success stemmed from savvy digital marketing, a compelling origin story (Rahal's own health crisis that led her to colostrum's healing properties), and premium positioning backed by scientific credentials.

Yet with success came new challenges. The colostrum category was growing crowded as competitors like Miracle Moo and WonderCow gained traction on social media, often at lower price points. ARMRA's aggressive digital marketing had fueled growth but potentially risked brand perception if perceived as too promotional. Meanwhile, the opportunity for retail expansion through natural grocery chains like Sprouts Farmers Market offered a path to wider distribution but would require significant operational changes and investment.

As Rahal reviewed the company's performance data and strategic options, she knew her next moves would determine whether ARMRA could evolve from a successful startup into a sustainable wellness powerhouse. Should the company double down on its successful direct-to-consumer model? Prioritize retail expansion? Diversify its product line? Or focus on strengthening customer retention and loyalty? The stakes were high, and the board expected clear recommendations at the upcoming meeting.

Company Background

Founding Story and Mission

ARMRA was founded in 2020 by Dr. Sarah Rahal, a double board-certified pediatric neurologist with expertise in environmental and functional medicine. The company's origin story was deeply personal: in 2017, Rahal had experienced a severe, mysterious gut illness that conventional medicine failed to resolve. Through extensive research, she discovered the healing potential of bovine colostrum—the nutrient-dense "first milk" produced by cows after giving birth. After developing her own premium colostrum formula that aided her recovery, Rahal left clinical medicine to launch ARMRA with a mission to "minimize the modern environmental impact on human health."

The company name itself reflected this mission: an acronym for "Armor," it represented strengthening the body's natural defenses against environmental threats. Rahal positioned colostrum as an ancestral superfood with modern scientific backing—a holistic solution rather than just another supplement. As she explained in interviews, "Our mission with ARMRA has been to create the highest-quality, most bioavailable colostrum possible, and make this timeless healing food accessible in the modern day."

Product Portfolio and Differentiation

ARMRA's initial product, "Immune Revival," was a powdered bovine colostrum concentrate launched in 2021. The company claimed its proprietary cold-chain processing method—branded as "Cold-Chain BioPotent™ Technology"—preserved over 400 bioactive compounds that would otherwise be damaged by conventional heat processing. This scientific approach differentiated ARMRA from competitors and justified its premium pricing (approximately $2 per serving, significantly higher than generic colostrum supplements).

The product line evolved gradually: first with single-serving travel "stick packs" for convenience, then with flavored options (Blood Orange, Vine Watermelon, and Sungold Apricot) to improve palatability. In late 2023, ARMRA introduced "Performance Revival," a specialized colostrum formula enhanced with raw cacao, black cumin seed, and tart cherry, targeting fitness enthusiasts. This measured expansion maintained focus on the core colostrum ingredient while addressing different consumer needs and usage occasions.

All ARMRA products emphasized quality: colostrum sourced from grass-fed cows on small American dairy farms, ethical "calf-first" collection (taking only surplus colostrum after calves' needs were met), third-party testing, and certifications including Keto and Paleo approval. The company also highlighted its environmental commitment, donating 1% of revenue to environmental causes and working toward carbon neutrality.

Business Model and Growth

ARMRA operated primarily as a direct-to-consumer brand. The company sold through its website (tryarmra.com) and Amazon, using a combination of one-time purchases and subscription options (with 15% discount for regular deliveries). This direct model allowed ARMRA to control the customer experience, maintain premium pricing, and collect valuable consumer data.

The company's growth had been remarkable. After bootstrapping the initial launch, Rahal secured seed funding in 2021 as demand accelerated. By early 2022, ARMRA reached a $1 million monthly run rate and had to manage inventory carefully, selling out three times that year due to surging demand. The growth continued, with 2023 revenue estimated at $120 million and projections for 2024 approaching $150 million.

Several factors drove this success:

Performance Marketing Excellence

ARMRA invested heavily in paid advertising across Meta platforms, Google, and TikTok, creating sophisticated retargeting funnels that followed interested shoppers across the web. The brand particularly excelled at conversion rate optimization, partnering with marketing technology providers to create personalized landing pages that matched ad messaging to the shopping experience.

Data shows that some of these targeted funnels achieved impressive 8% conversion rates—significantly higher than industry averages for supplements. By constantly measuring CAC (Customer Acquisition Cost), LTV (Lifetime Value), and ROAS (Return on Ad Spend), ARMRA optimized its digital marketing spend for maximum efficiency.

Influencer Marketing That Drives Viral Growth

Perhaps the most significant factor in ARMRA's digital success has been its expansive influencer marketing program. The company systematically built relationships with content creators in the wellness, fitness, and beauty niches—from micro-influencers to major wellness personalities.

Rather than scripted advertisements, ARMRA encouraged authentic storytelling about personal experiences with colostrum. This approach generated relatable content that felt educational rather than promotional. When influencers shared morning routines featuring ARMRA in their coffee or smoothies, viewers saw a practical application rather than a hard sell.

The strategy proved remarkably effective at creating viral moments on platforms like TikTok and Instagram, where viewers would see multiple trusted voices independently recommending this novel supplement. ARMRA then amplified this organic-feeling content through paid distribution, effectively blurring the line between word-of-mouth and advertising.

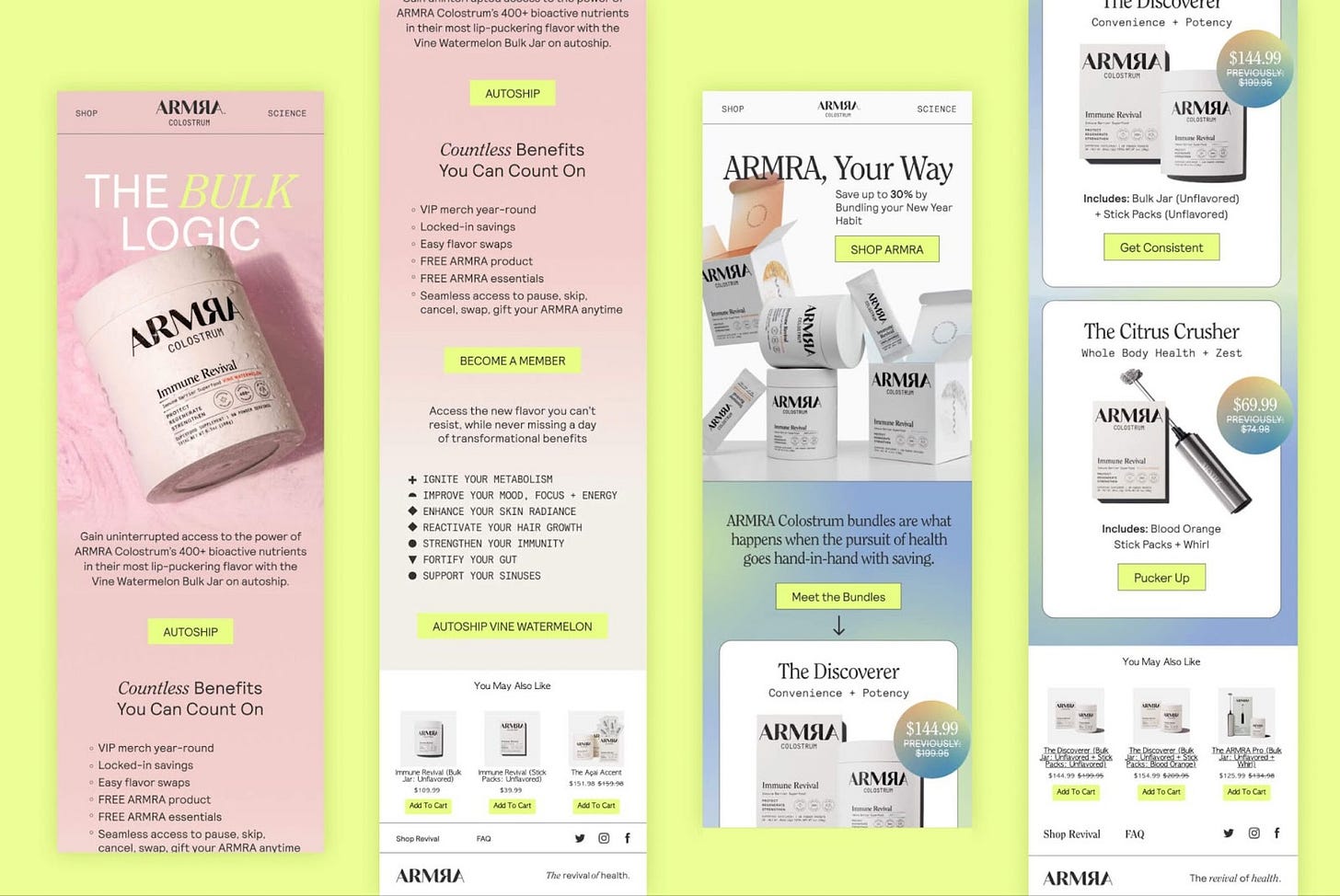

Subscription Commerce Focus

Like many successful DTC brands, ARMRA recognized the value of recurring revenue. The company implemented a subscription program offering a 15% discount on regular deliveries, which helped improve customer lifetime value. Through A/B testing different offers and user experiences, ARMRA achieved a 135% increase in first-order subscription opt-in rates without sacrificing overall conversion.

This subscription focus transformed ARMRA's business model from transactional to relationship-based. With approximately 35% of customers on subscription, the company reduced its dependence on continuously acquiring new customers—a significant advantage as acquisition costs rise across digital platforms.

Premium Digital Positioning in a Competitive Market

ARMRA has maintained premium pricing ($1.50-$2.00 per serving) in a category where many alternatives sell for half that price. This pricing strategy has been supported by several digital brand-building elements:

Founder-Led Storytelling

Dr. Rahal's medical background and personal health journey feature prominently across ARMRA's digital presence. From the website's "Our Story" section to podcast appearances and social media content, her expertise provides credibility that many supplement brands lack. This founder-led narrative helps justify the premium price point while differentiating ARMRA from less transparent competitors.

Science-Backed Education

ARMRA's digital content strategy extends beyond product promotion to comprehensive education about colostrum's benefits. The brand has positioned itself as a thought leader, publishing blog articles, social media explainers, and email content that connects colostrum to trending health concerns like gut permeability, immune function, and recovery.

This educational approach is particularly effective in eCommerce, where consumers research extensively before purchasing supplements. By answering questions and addressing objections before they arise, ARMRA reduces purchase friction while positioning itself as a premium, science-backed option.

Clean, Premium Branding

ARMRA's digital aesthetic reflects its premium positioning with minimalist design, earthy colors, and clinical-yet-approachable visual elements. The website emphasizes quality markers like "grass-fed," "non-GMO," and "tested for purity"—critical trust signals in the supplement space.

Product photography shows ARMRA integrated into aspirational wellness routines, emphasizing its daily-ritual status rather than purely medicinal use. This lifestyle positioning has helped the brand transcend the typical supplement category limitations.

Strategic Challenges at the Growth Inflection Point

By early 2024, ARMRA faced the challenges that many successful eCommerce brands encounter as they scale: how to maintain growth momentum while protecting brand equity and operational excellence. Three key strategic questions emerged:

1. The Marketing Efficiency Challenge

As competition increased and platforms matured, ARMRA's customer acquisition costs rose approximately 30% over 18 months. This trend mirrors what many DTC brands experience—early adoption comes from the most responsive audiences, but reaching broader segments becomes progressively more expensive.

The company faced a critical question: Should it continue to scale digital marketing spend despite declining efficiency, or shift focus to retention and community building? Each path offers different risk-reward profiles for an eCommerce business at this stage.

2. Product Expansion vs. Core Focus

ARMRA built its brand around a single hero ingredient (colostrum) but gradually expanded with format variations (stick packs for convenience) and flavors (Blood Orange, Watermelon) to improve the user experience. In 2023, it launched Performance Revival, targeting athletes with added functional ingredients.

The product development team had numerous ideas for additional formulations targeting specific need states (beauty, cognitive function) or demographics (children, seniors). However, each new SKU would require significant inventory investment and marketing support—a common dilemma for growing eCommerce brands balancing focus against expansion.

3. The Omnichannel Evolution

Perhaps the most consequential decision facing ARMRA was whether to expand beyond DTC into retail distribution. Sprouts Farmers Market, a national chain with over 400 natural food stores, approached ARMRA about a potential nationwide launch—a transformative opportunity that would require significant operational changes.

Retail expansion would bring broader awareness and new customer acquisition, potentially adding $50 million in first-year revenue. However, it would also introduce lower margins, inventory complexity, and potential channel conflict. This omnichannel question represents a critical crossroads that many successful digital-native brands eventually face.

Market Landscape and Competition

Supplement Industry Overview

The U.S. dietary supplement market was robust, valued at $35.7 billion in 2022 with projected growth of 2.5% annually through 2027. Consumer interest in preventive health had accelerated post-COVID, particularly for immunity and gut health supplements. While traditional sales channels (retail stores) still dominated the overall supplement market—accounting for 78% of sales—direct-to-consumer brands had gained significant traction with digitally-native consumers seeking premium, specialized products.

The colostrum segment specifically was growing rapidly, with the global market valued at approximately $3.6 billion in 2024 and projected to grow at 7% annually through 2030. This growth reflected increasing research on colostrum's benefits for immunity, gut health, and athletic performance, alongside rising consumer interest in "food as medicine" rather than synthetic supplements.

Regulatory oversight of supplements remained relatively light under FDA guidelines, allowing considerable marketing freedom but also creating quality concerns. Consumers increasingly sought brands with transparent sourcing, clean ingredients, and scientific backing—all areas where ARMRA had positioned itself strongly.

Competitive Landscape

ARMRA faced competition on multiple fronts:

Direct Colostrum Competitors:

WonderCow: An emerging brand with grass-fed colostrum powder at a similar price point, emphasizing high IgG content (antibodies) and muscle recovery benefits. Strong Amazon reviews and social media presence made it ARMRA's most direct competitor.

Miracle Moo: Dubbed the "#1 colostrum product on TikTok," this brand offered a patented IgG-rich ingredient called ImmunoLin and leveraged viral social content, though its product contained more additives than ARMRA's.

Sovereign Laboratories: An established player with "Colostrum-LD" using liposomal delivery technology for claimed better absorption.

NOW Foods, Jarrow, and others: Legacy supplement brands offering budget-friendly colostrum options without the premium positioning or special processing claims.

Adapt Naturals: A newer entrant by health expert Chris Kresser with similar quality standards (grass-fed, cold-processed) and 40% IgG content, representing growing competition in the premium segment.

Broader Supplement Competition:

Immune support supplements: Vitamin C, D, zinc, elderberry, and mushroom blends targeting similar health concerns.

Gut health products: Probiotics, prebiotics, and digestive enzymes addressing overlapping benefits.

Protein and recovery supplements: Whey protein, collagen peptides, and specialized athletic formulas competing with ARMRA's Performance Revival.

Comprehensive wellness powders: Products like Athletic Greens (AG1) and Ka'Chava offering all-in-one solutions that could displace category-specific supplements.

ARMRA differentiated through its doctor-founded credibility, proprietary processing technology, and premium branding. However, the barriers to entry remained relatively low—as evidenced by new colostrum brands emerging regularly—putting pressure on ARMRA to continuously innovate and strengthen its market position.

With intensifying competition in the supplement market, ARMRA's strategic decisions would determine whether it could maintain its leadership position. Despite its strong differentiation through doctor credentials, proprietary processing technology, and premium branding, the low barriers to entry in the supplement space meant constant pressure to innovate and strengthen market position.

Navigating the Strategic Crossroads

Facing these competitive pressures, Dr. Rahal found herself at a critical decision point in January 2024. With annual revenue approaching $120 million and impressive financial metrics—70% gross margins on direct sales and a healthy 4:1 LTV:CAC ratio—ARMRA had built a strong foundation. However, the company couldn't pursue every opportunity simultaneously without risking operational excellence. Three distinct strategic paths emerged:

The first option involved doubling down on digital marketing by increasing ad spend, expanding influencer partnerships potentially to include celebrities, and refining conversion optimization techniques. This approach would build on ARMRA's proven strengths but faced challenges from rising acquisition costs and potential digital marketing saturation.

Alternatively, ARMRA could pursue balanced growth through product innovation—maintaining moderate marketing spend while introducing new colostrum formulations and exploring alternative formats like capsules or ready-to-drink options. This strategy would address competitive threats but risked diluting focus.

The third path meant embracing omnichannel distribution through the Sprouts Farmers Market partnership, transforming ARMRA from a digital-native brand to an omnichannel wellness company. While this approach would reach new customer segments, it would significantly change ARMRA's operational model and economics, with retail margins at 45% versus 70% for direct sales.

What made this decision particularly challenging was that each path offered potential rewards balanced against real risks. The company's impressive metrics—subscription rate at 35%, growing average order value ($90, up from $60), and a marketing efficiency ratio of 2.8:1—indicated multiple viable paths forward. Yet with a relatively small team of 45 employees and manufacturing capacity already at 90% utilization during peak seasons, ARMRA faced real constraints on its ability to execute across multiple fronts simultaneously.

As Dr. Rahal weighed these options, she returned to ARMRA's founding mission: transforming health at scale through premium colostrum products. The decisions she made would not only determine ARMRA's future but also provide valuable lessons for other eCommerce entrepreneurs navigating the delicate balance between scale and focus, digital purity and omnichannel complexity, and immediate growth versus long-term sustainability in an increasingly competitive wellness landscape.